“Value hasn’t worked in the US, but it’s worked fine internationally.”

That was according to investor and author Daniel Rasmussen, whom I recently interviewed for The Long View podcast. Rasmussen admitted that the underperformance of value stocks in the US market had shaken his faith in the investment style. “I’ve been a value investor through a horrid period for being a value investor,” he said, joking that’s why his recent book is titled The Humble Investor instead of “The Arrogant Investor.”

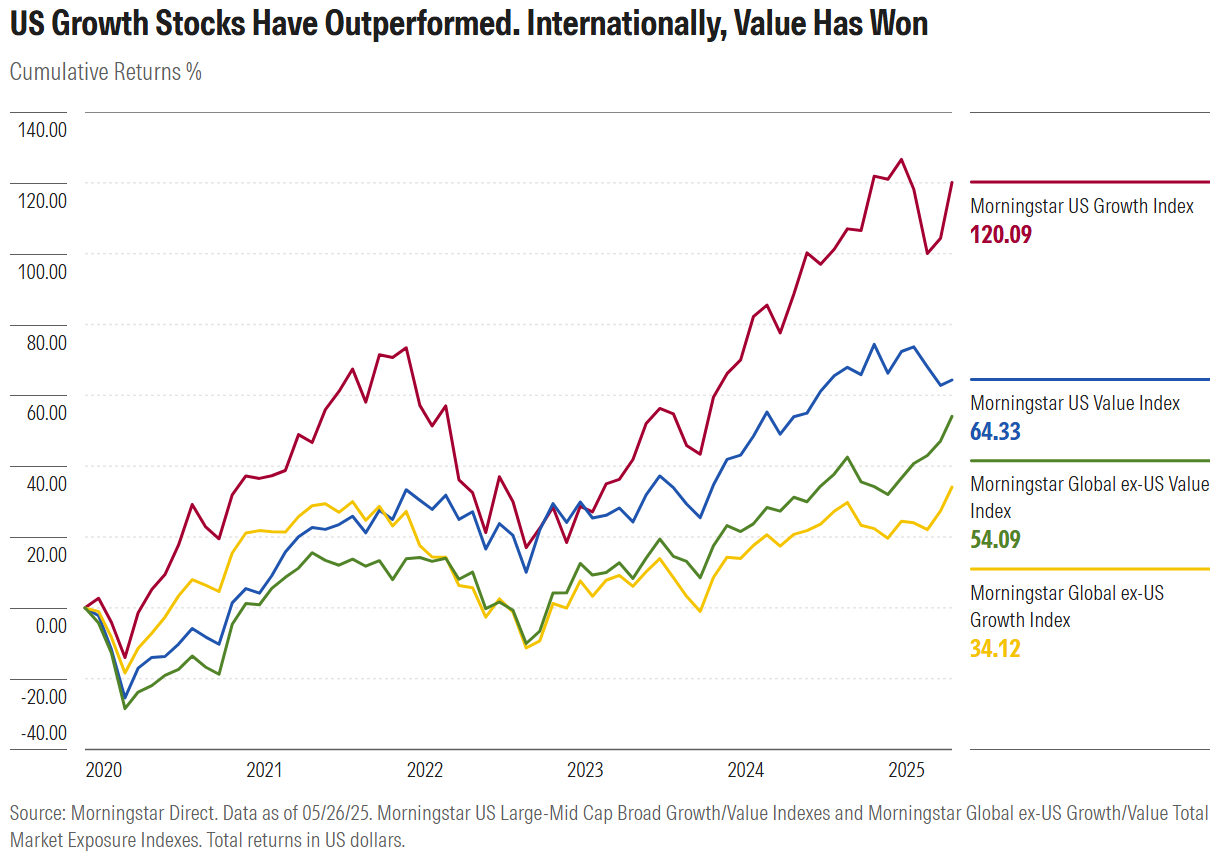

I was intrigued by Rasmussen’s observation about the success of value investing outside the US. So, I looked at Morningstar‘s indexes representing international growth and value stocks. Sure enough, value investing has prospered beyond American shores. This year, the Morningstar Global ex-US Value Total Market Exposure Index is ahead of its growth counterpart by nearly 5 percentage points. But even over the past three, five, and 10 years, periods in which growth trounced value in the US, the picture looks different internationally.

Why the disparity? Are there regional nuances? And what can we learn from the outperformance of value investing outside the US?

‘Magnificent Seven’ vs. ‘Granolas’

The first thing you might notice about the performance chart above is that US stocks of all styles have beaten international stocks. That trend actually goes back much further than 2020. “US exceptionalism” has been magnified by a strengthening dollar. It’s also about superior returns on invested capital and expanding price multiples.

As is commonly known, technology themes have ruled the US stock market for years. In 2023 and 2024, artificial intelligence was the key investment theme. Before that, the pandemic accelerated long-running trends around e-commerce, cloud computing, and mobile. Morningstar‘s US growth index is dominated by the “Magnificent Seven,” which includes names like Nvidia NVDA, Tesla TSLA, Microsoft MSFT, Alphabet GOOGL, and Apple AAPL. Some of these companies have achieved market capitalizations surpassing $3 trillion.

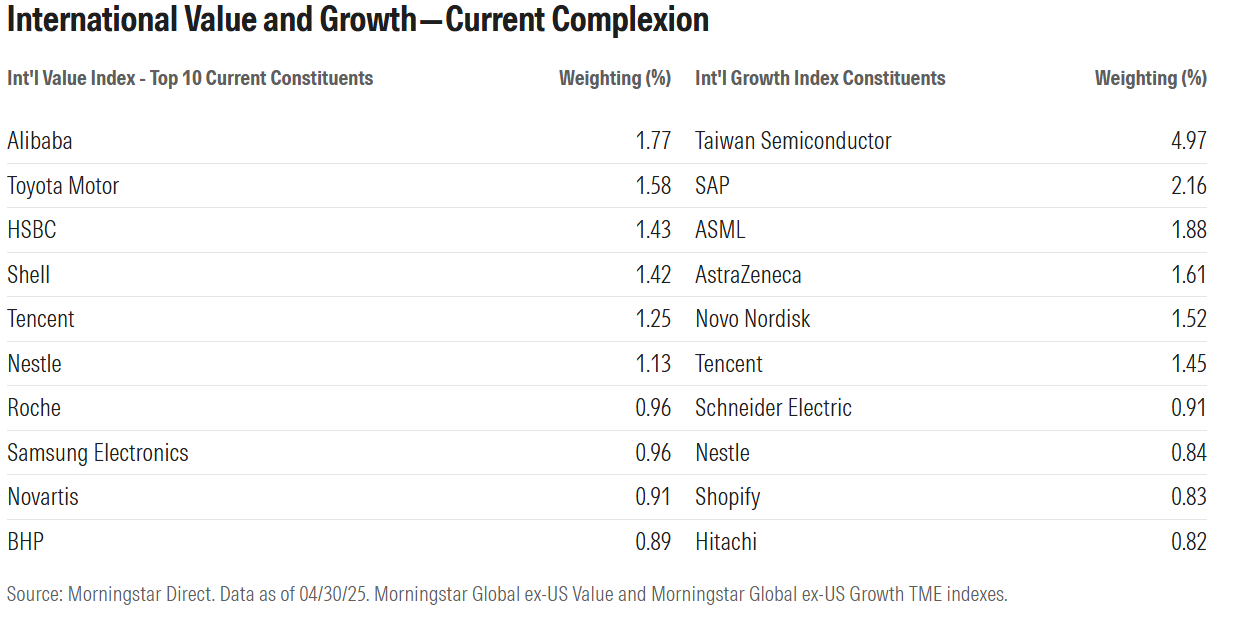

Internationally, the scale is far smaller. There is not a single public company outside the US currently worth $1 trillion. Taiwan Semiconductor TSM, which has benefited from many of the same trends as the US growth stock behemoths, comes closest at $911 billion as of the end of April 2025.

There was a time when the “Granolas” stocks were being promoted as Europe’s answer to the Magnificent Seven. Granolas was an acronym for GSK GSK, Roche RHHBY, ASML ASML, Nestle NSRGY, Novartis NVS, Novo Nordisk NVO, L’Oreal LRLCY, LVMH Moet Hennessy Louis Vuitton LVMUY, AstraZeneca AZN, SAP SAP, and Sanofi SNY. As my colleague Jocelyn Jovene wrote in early 2024, “Granolas represent a much broader cross-section of the economy, with names from the healthcare, consumer defensive, and consumer cyclical sectors.” ASML, a Netherlands-based maker of semiconductor manufacturing equipment, is the only Granolas member with a real link to the aforementioned technology trends.

Don’t blame yourself if you haven’t heard of the Granolas. They never really rivaled the Magnificent Seven from a performance perspective. True, Novo Nordisk did enjoy a massive runup thanks to its weight-loss therapy, becoming Europe’s largest public company in 2023. But the collective market value of the 11 Granolas only reached $2 trillion at the end of 2024, comparable in size to Amazon.com AMZN—the fourth-largest member of the Magnificent Seven. Some of the Granolas actually appear in both the international growth and value indexes, albeit at different weights.

So, what has boosted value investing internationally in recent years? Morningstar‘s international value index owes a good chunk of its outperformance to the financial-services sector. Banks like HSBC HSBC, Banco Santander SAN, and BNP Paribas BNPQY have been lifted by higher interest rates. Other key contributors include energy stocks like Shell SHEL and TotalEnergies TTE, which got a big boost when oil prices spiked following Russia‘s 2022 invasion of Ukraine.

Looking Beyond Europe With Style

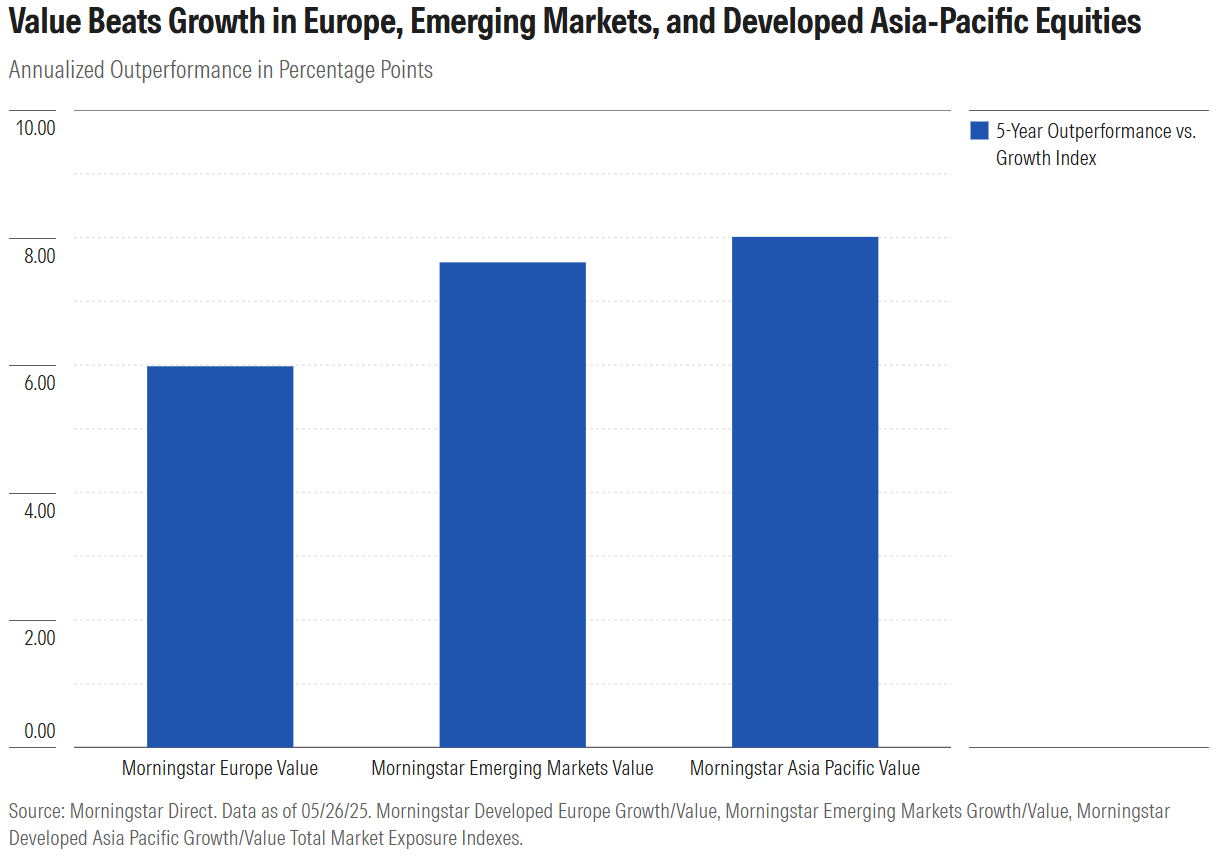

While value has outperformed growth in Europe over the past five years, Europe now represents less than half of equity market capitalization outside the US. How has value investing performed in emerging markets like China, India, and Brazil? What about Japan?

According to the table below, value stocks in emerging markets and developed Asia have outperformed by an even larger margin than in Europe.

The largest international value stock is currently Alibaba BABA, the Chinese internet behemoth. How does an online and mobile commerce business that’s often compared to Amazon end up in a value index, alongside banks, oil companies, and industrials? As I wrote about earlier this year in a China-focused column, Alibaba was one of the world’s 10 largest public companies at the end of 2020. Then came government intervention that wiped billions in market value from Alibaba and its peers. The decline of Chinese internet companies, which were once big growth stocks, helps explain why value investing has triumphed over growth investing in emerging markets in recent years. Samsung Electronics SSNGY is another underperformer for emerging-markets growth.

What about among developed markets in the Asia-Pacific region? Japan represents roughly two thirds of equity market value in this universe, with Australia another 20%. In Japan, rising interest rates and improved economic and investment conditions have disproportionately benefited financial-services stocks, which tend to reside on the value side of the market. Mitsubishi UFJ Financial Group MUFJ and Sumitomo Mitsui Financial Group SMFG have both been big winners for value investors. In Australia, however, growth has beaten value over the past five years. That’s a small, narrow market, though.

Value’s Underperformance in the US: Is It Macro or Micro?

While I have mentioned some macroeconomic factors above, I am generally skeptical of attempts to explain style leadership from the top down. Back in 2022, when sticky inflation prompted the largest interest-rate hikes in a generation, US growth stocks fell much further than value. A popular narrative arose: Growth stocks are more sensitive to interest rates. Higher rates, it was said, devalue the long-dated earnings of fast-growing companies with pricey shares.

There were other factors at work, though. Corporate earnings expectations moderated in 2022. Growth stocks came into that year hot, and it’s often the highflyers that fall furthest in selloffs. Sector effects were also at play. Soaring energy stocks and defensive areas like healthcare boosted the value side of the market.

In any case, the narrative around rates and style leadership faded fast. Growth bounced back in 2023 despite high rates. The Magnificent Seven and others rode a wave of enthusiasm for AI. Growth stocks’ thriving amid higher rates is hardly unprecedented. Between 2015 and 2018, the US Federal Reserve hiked rates several times, yet growth beat value by a wide margin.

Ultimately, I agree with Dan Rasmussen that the triumph of growth over value in the US has more to do with “historically unique and rare circumstances.” As Rasmussen pointed out: “The US has been through an innovation wave ... where these large-cap tech companies have so dramatically performed in terms of their fundamentals such as to be in the top 1% of the historical sample in terms of growth rates of earnings and profits and revenue, and to have done that on such a massive scale was unprecedented.”

I’ve been following markets long enough to know that style leadership can be cyclical. In fact, I remember when growth investing was considered ridiculous. After the dot-com bubble burst in 2000, US value stocks outperformed for years. Growth was associated with late-1990s excess, Pets.com, and metrics like “eyeballs.” The financial-services sector boomed in the mid-2000s, helping value investors but sowing the seeds of the next crisis. Few grasped in those years that 90s-era growth themes like e-commerce and internet search were on their way to becoming profitable.

The tables have turned, and now it’s value investing that’s being fundamentally questioned. Value stocks have been called “structurally challenged,” in “secular decline,” and “value traps.” But the value side of the market has always been home to troubled companies. Value investing is about stocks that underpromise and overdeliver.

Perhaps the long-term cycle will turn again in value’s favor. AI could be revolutionary, but, like the internet, ahead of itself from an investment perspective. We could look back at 2025 as a historical inflection point, as marking a new market regime.

The problem is that these things are only clear in retrospect. It will take time to know if the rotations we’ve seen in early 2025 will last, or if they’re just head fakes. We’ve seen other episodes of value beating growth in the US, including 2016, 2022, and the third quarter of 2024. Growth retook leadership in all cases.

For now, the triumph of value stocks outside the US should provide some comfort to value investors everywhere. International markets, especially developed ones, aren’t all that different. Many European and Japanese companies compete globally, even earning substantial revenue from the US. Correlations between US and international stocks have risen. If value investing were fundamentally “broken,” it would probably be a universal phenomenon.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.