“We have been net sellers of large and mega-cap companies and buyers of mid-cap companies.” That’s what value investor Brian Selmo of First Pacific Advisors told me recently on Morningstar’s The Long View podcast. Selmo is a bottom-up stock-picker who goes where he sees valuation-driven opportunity. He said he was finding “classically good businesses” in today’s market—profitable, financially stable, well-managed, trading between 8 and 14 times earnings, and none larger than $30 billion in market capitalization.

Morningstar’s Equity Research team shares Selmo’s view that there’s more upside potential lower down the market-capitalization spectrum. Coming into the third quarter, my analyst colleagues saw US large caps as overvalued in aggregate, mid-caps as fairly valued, and small caps as undervalued. They cautioned, though, that small caps face headwinds, including high interest rates and economic uncertainty.

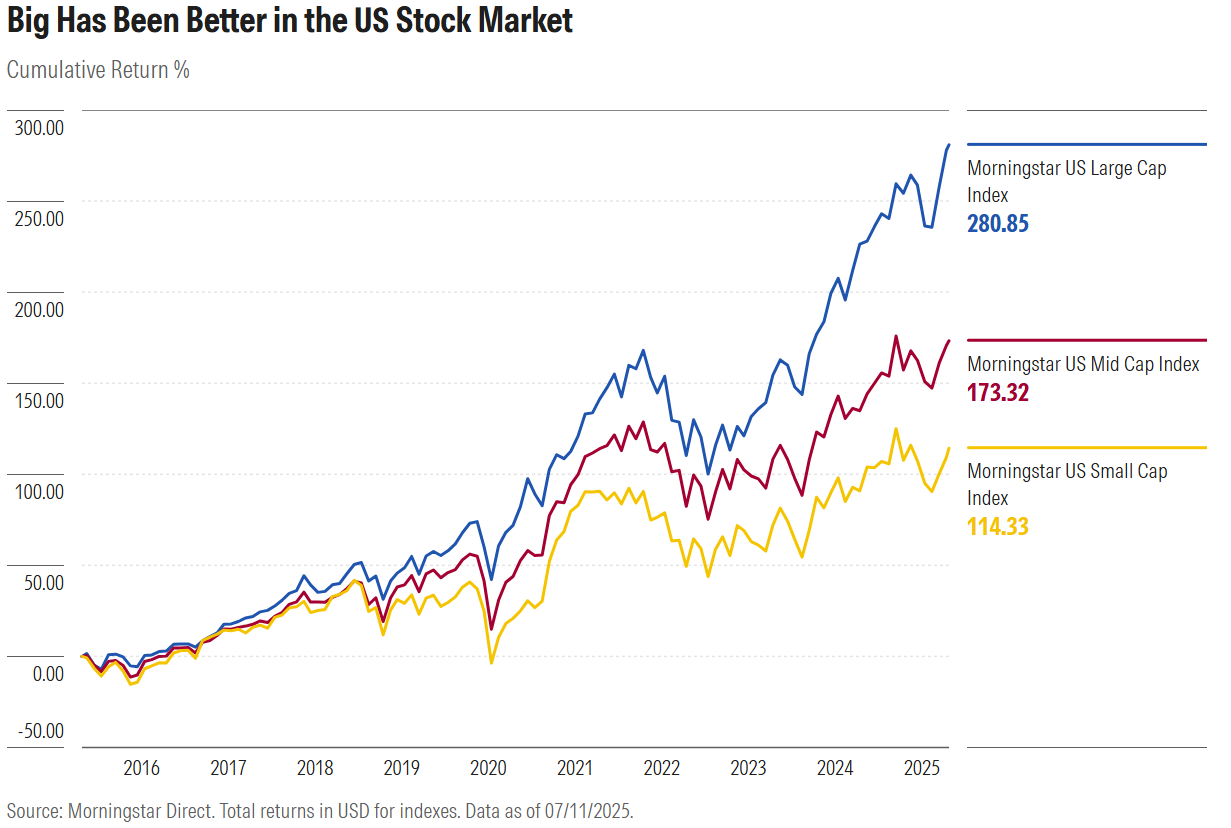

The time seems right to examine the middle range of the US stock market, just as I took a deep dive into small caps earlier this year. The Morningstar US Mid Cap Index has underperformed its large-cap counterpart but outperformed small caps so far in 2025 and for the past three, five, and 10 years.

While better days may be ahead—at least on a relative basis—one has to wonder: Do investors really need a separate mid-cap allocation?

Why Don’t You Just Meet Me in the Middle?

I must admit I was surprised by the $30 billion market-capitalization figure Selmo mentioned in relation to mid-caps. It sounded substantial. Clearly, I haven’t been paying close enough attention to changing US stock market dynamics.

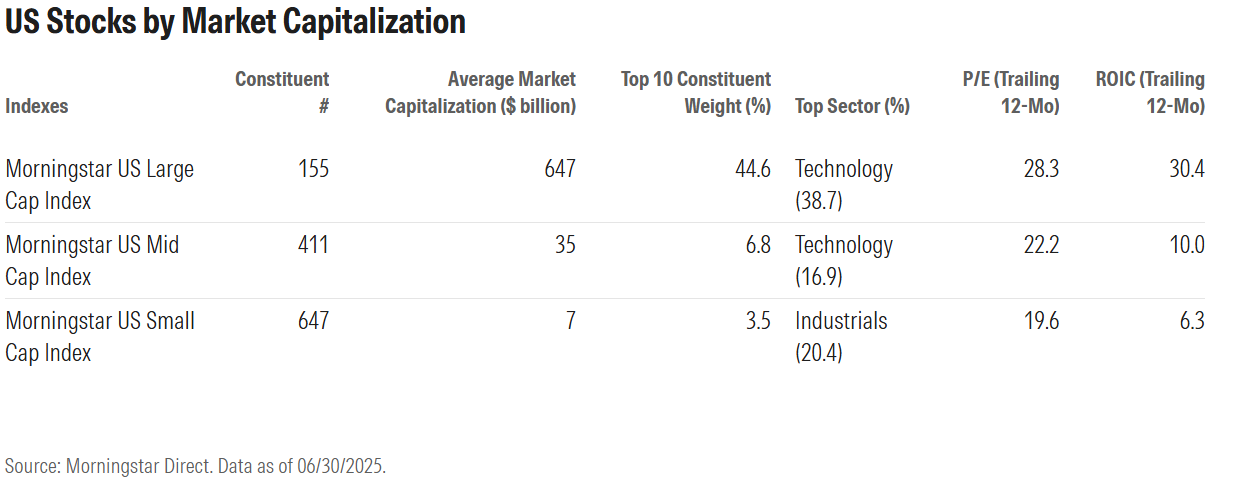

The largest of the 411 current constituents of the Morningstar US Mid Cap Index is Capital One COF, which is worth more than $100 billion. Morningstar defines capitalization ranges in relative terms. According to the Morningstar Style Box methodology, large-cap stocks represent the top 70% of the market; mid-caps are the next 20%, and small caps are below that. Here are some interesting data points on the capitalization ranges following the index reconstitution in June.

The table tells the story of a top-heavy market. As we all know, a group of superstar “hyperscalers” has reigned supreme for more than a decade. With seven companies exceeding $1 trillion in market capitalization, it only takes 155 stocks to represent the top 70% of the market, down from 274 a decade ago. Meanwhile, the Morningstar US Mid Cap Index has also shrunk—from 623 constituents in mid-2015—but it’s significantly more diffuse in terms of stock and sector weights. It’s also less profitable and trading at lower price/earnings multiples.

By its nature, the mid-cap space is transitory. The Morningstar US Mid Cap Index contains some fast-growing companies that were small caps not long ago—names like Rivian RIVN, Carvana CNVA, and Interactive Brokers IBKR. Then there are stocks moving in the other direction, fallen large caps, such as Royal Caribbean RCL, Lululemon LULU, and Snap SNAP. You might also recognize some companies that have recently come to market through initial public offerings, including CoreWeave CRWV and Reddit RDDT. Then there are spinoffs like Kenvue KVUE, which was formerly Johnson & Johnson’s JNJ consumer health segment.

Performance wise, the technology sector has been the biggest factor for mid-caps. Technology stocks like Palantir PLTR and Marvell MRVL, which have since graduated to large-cap status, contributed significantly to the mid-cap index’s 10-year returns. But technology has helped large caps even more, especially Nvidia’s NVDA near-6000% gain and Microsoft’s MSFT more than 10-fold appreciation since 2015. (There are also one-time tech stocks Alphabet GOOGL and Meta Platforms META, which were reclassified to the communication-services sector.)

Small-cap tech stocks, for their part, have not kept up. Big has grown bigger. Large caps have been the place to be in the US market for more than a decade.

What Does the Future Hold for Mid-Caps?

One lesson from the past 10 years is that large caps have plenty of upside potential. In theory, it’s easier to grow off a smaller base. Yet, we’ve watched companies go from $1 trillion in market capitalization to near $4 trillion in just a few years. They’ve defied warnings of “bubbles” and brushed off “monopolist” accusations.

That said, smaller stocks have enjoyed many historical periods of dominance. Academics have even shown that small caps have outperformed large caps over the very long term. The “size premium” holds that smaller stocks compensate investors for their risk. In the years following the internet bubble bursting in 2000, US small caps were the place to be.

As far as current valuations are concerned, my colleagues on Morningstar’s Equity Research team see a wide dispersion between the expensive growth side of the mid-cap segment and the more attractive value side. Vistra VST, Roblox RBLX, and Take-Two Interactive Software TTWO are examples of mid-growth stocks the analysts see as trading at a steep premium to their estimates of intrinsic value. On the other side of the coin, the Morningstar US Small-Mid Cap Moat Focus Index contains several mid-cap value stocks seen as bargains, such as Clorox CLX, Zimmer Biomet ZBH, and FirstEnergy FE.

What Do Mid-Cap Stocks Add to a Portfolio?

The truth is, the middle of the market can get lost in the shuffle. Whereas small caps are widely considered an asset class, many investors don’t allocate separately to mid-capitalization stocks. That’s for good reason.

They may already have mid-cap exposure through their core US equities funds. Some passive strategies include mid-caps, depending on the methodology of the indexes they track. Meanwhile, active managers’ propensity to wander the capitalization spectrum makes the Morningstar US Large-Mid Cap Index a better benchmark for the large-blend Morningstar category for funds and exchange-traded funds than its pure large-cap carveout.

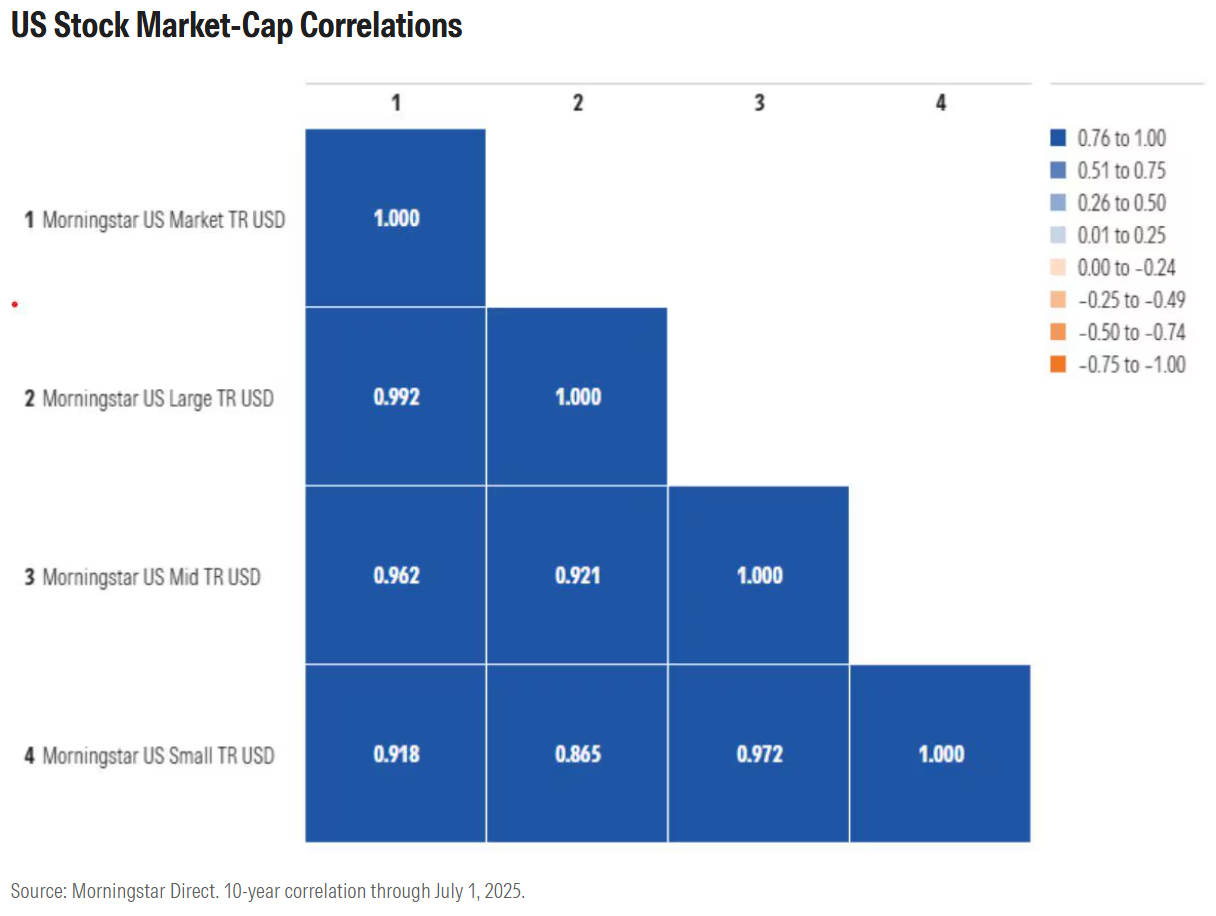

Unsurprisingly, US mid-caps are more closely correlated to the broad stock market than are small caps. Mid-caps are also more correlated to large caps. So, from the perspective of portfolio diversification, mid-caps don’t offer a whole lot of benefit.

Of course, the correlation coefficient only tells us about direction, not magnitude. Just because mid-caps are moving in concert with large caps does not mean the size of those movements is the same. US large caps’ long run of outperformance could reverse.

For investors who like to allocate tactically to different slices of the market, there’s an argument for underweighting larger companies and sliding down the market-cap scale today. Stock-pickers like Brian Selmo would naturally favor a selective approach to the asset class. The Morningstar US Small-Mid Cap Moat Focus Index highlights smaller stocks that, in the eyes of my equity analyst colleagues, are both attractively valued and competitively advantaged.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.