The word “rotation” has trended heavily in reference to investment performance in 2025. As I discussed in last week’s column, several long-running market trends have reversed this year. Bonds have beaten stocks. Non-US equities have led. And within the US market, value’s topping growth.

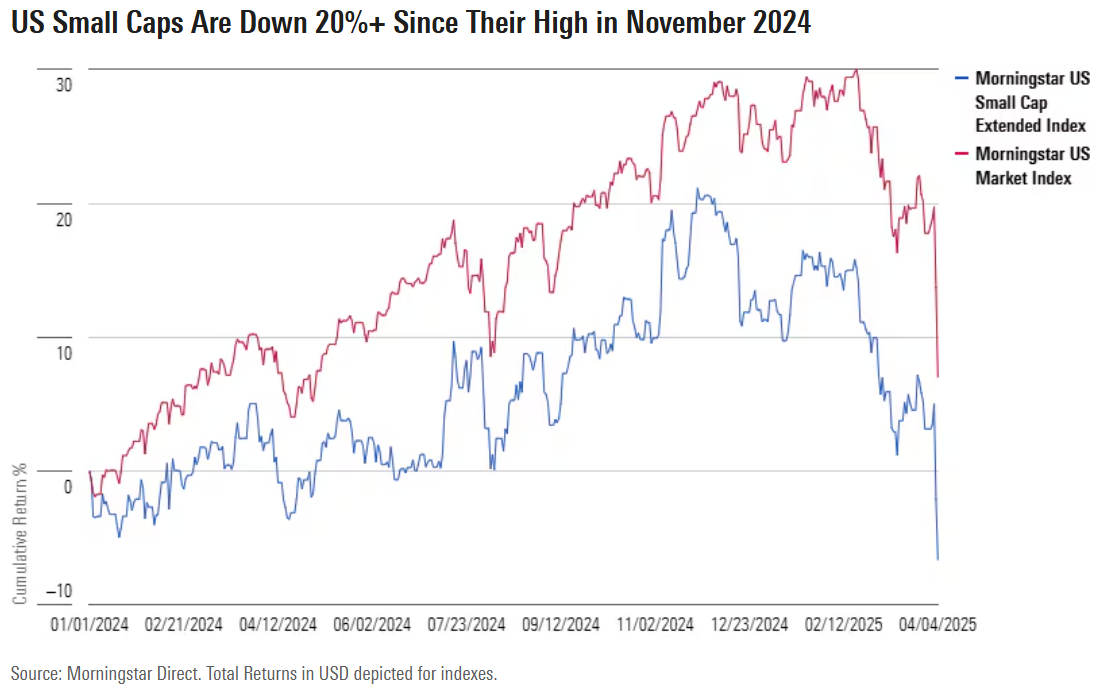

One notable segment has failed to rotate, however. Stocks in the bottom 10% of the market, as represented by the Morningstar US Small Cap Extended Index, are far behind the broad equity market so far this year. In fact, the small-cap benchmark fell 23% from its postelection high on Nov. 25, 2024, through April 4, 2025. A decline of more than 20% is the technical definition of a bear market.

This extends a multiyear stretch of underperformance for stocks with small market capitalizations. You have to go back to 2016 for the last calendar year in which our small-cap benchmark meaningfully outperformed the Morningstar US Market Index, a broad gauge of equities. Small caps have lagged in up and down markets, rising and falling interest-rate environments, and periods of economic expansion and contraction. Remember, this is an asset class that is supposed to possess a long-term performance advantage, according to academic research.

Are small caps even worth the trouble? Call me stubborn, but I’m maintaining my small-cap exposure—in the US and around the world. You don’t have to believe in a “size premium” to think their future may be brighter than the recent past.

What Happened to the Small-Cap Effect?

According to academic research, stocks with small market capitalizations outperform over the long term.[1] Smaller, less-liquid, less-proven companies are more volatile than their larger cousins and, the theory goes, should compensate investors for the extra risk they bear. The “small-cap effect” identified by the academics has birthed an asset class tracked by trillions in investor capital.

Over the course of my career, I’ve seen small caps go through several performance cycles. They lagged the broad US equity market badly in the late 1990s. But when the dot-com bubble burst in 2000, small caps lost far less than larger stocks, and then they outperformed for years. The stock market epoch preceding the financial crisis of 2008 was characterized by small over large, value over growth, and non-US equities on top. US small caps fell in line with the broad market in 2008, but the recovery of 2009-10 benefited them disproportionately.

In the ensuing years, the trends that defined the first decade of the millennium reversed, with large caps taking over leadership from small, growth trouncing value, and US equities reigning supreme. As we all know, a cohort of superstar mega-caps has dominated US stock market performance. The phenomenon that started in 2013 as FANG—Facebook (now Meta META), Amazon.com AMZN, Netflix NFLX, and Google GOOGL (now Alphabet)—and evolved into the “Magnificent Seven” (Netflix was out. Tesla TSLA, Apple AAPL, Nvidia NVDA, and Microsoft MSFT were in) left small caps in the dust.

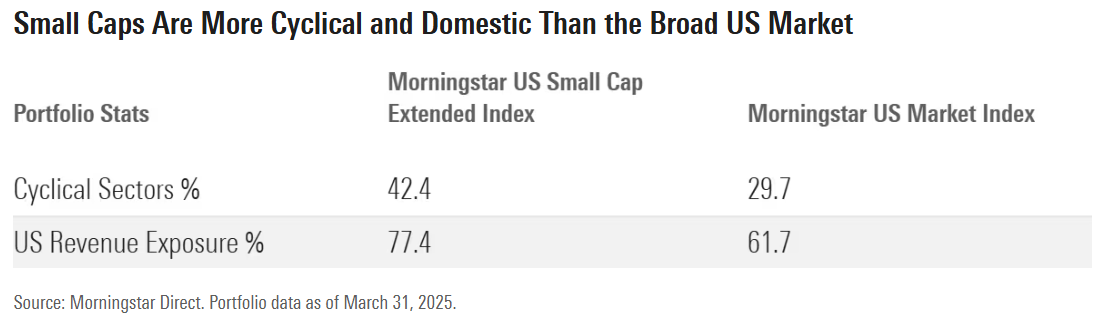

What’s more, small caps’ underperformance has spanned a variety of macro conditions. For example, small caps fell further than the market during the pandemic-driven economic downturn of 2020 but lagged during the recovery when rates were slashed. That’s notable because small caps are widely perceived to be more economically sensitive than their larger counterparts. As a group, they are more domestically focused and less diversified in their business lines than large caps, with more exposure to interest rates, consumer demand, and commodities prices.

From the perspective of economic sector exposure, small caps are certainly more cyclical than the broad market. Morningstar’s small-cap index is far lighter on technology stocks and heavier on sectors like industrials, real estate, financial services, and consumer cyclicals than the overall US market. According to Morningstar estimates of corporate revenue sources, 77% of the small-cap index’s revenue is US-based, while the broad market is just 62% domestic.

These biases help explain why small caps rallied around the US elections of 2016 and 2024. In both cases, small caps were seen as “Trump trades.” Anticipated tax cuts, deregulation, and policies in favor of growth were all seen as benefits. Tariffs, in theory, boost domestic businesses.

Why then have small caps underperformed in 2025? It’s certainly not about sectors. Lighter exposure to technology stocks has been a huge plus this year. First-quarter performance attribution analysis for the Morningstar US Small-Cap Extended Index blames it on individual constituents across sectors—names like American Airlines AAL, SoFi Technologies SOFI, and IonQ IONQ. Recession fears, stubbornly high interest rates, and a “risk off” market vibe can’t have helped. The frustration is that small caps failed to thrive during strong economic times, falling rates, and risk-on markets like 2021, 2023, and 2024.

Some theorize that small caps are suffering from structural factors. Perhaps the rise of private markets has contributed. Could it be that the small-cap space has suffered from companies staying private or going public at larger sizes than in the past?

My colleague Aniket Gor on Morningstar Indexes pulled data on US IPOs, and we found the results inconclusive. In the booming stock market of 2021, loads of private companies pursued “exits” through public markets. We didn’t see a pattern of companies coming to market at larger relative sizes than in the past. I’d also note that the rise of private markets is a global phenomenon, yet small caps outside the US haven’t underperformed so badly. The Morningstar Global Markets ex-US Small Cap Index has beaten its broad market equivalent during periods in which US small caps lagged.

Small Caps’ Day Could Come, but Patience Is Key

Whatever your view on the size premium, there are reasons to think the asset class has potential. Years of underperformance have left small caps as a whole with some pretty low valuations, putting them in a position to underpromise and overdeliver.

In February, my colleagues in Morningstar Investment Management wrote:

Small caps are often overlooked, making them a prime example of an asset class where even a small amount of positive news can shift sentiment. They’ve been unloved because they have underperformed, and because of that, they remain historically undervalued versus large caps.

There’s a strong argument for a selective approach to small-cap investing. Many of the companies in the small-cap index are unprofitable. Research has shown that screening for quality in small-cap stocks helps restore the size premium. That was the conclusion of a 2015 paper cheekily titled “Size Matters, If You Control Your Junk,” by Cliff Asness and his colleagues at AQR Capital.

A large and diffuse universe of poorly followed companies of varying degrees of profitability has provided a target-rich hunting ground for active managers—at least relatively speaking. According to the Morningstar Active/Passive Barometer, active small-cap managers have higher success rates than large-cap or mid-cap managers. Still, less than half the small-cap strategies in Morningstar’s database beat their passive peers and avoided liquidation in the 10 years through 2024.

On the timing front, yet more patience may be required from small-cap investors. “Small-cap stocks remain very attractively valued,” wrote Morningstar’s chief US market strategist David Sekera in a Q2 2025 market outlook, “but it may take a while before they start to work.” Sekera’s valuation call leverages the company-specific work of Morningstar equity analysts. His skepticism that a small-cap rebound is imminent relates to a weakening US economy and a Federal Reserve that’s not rushing to cut rates. Analysis by my colleague Amy Arnott concludes that large-cap stocks have historically held up better during economic downturns.

At the end of the day, there are many variables influencing investment behavior. Macro and micro variables, sector effects, sentiment, and valuation all come into play. The net effect has been unfavorable to small caps for a long time. But given history and today’s low valuations, I’d be surprised if we don’t see a small-cap renaissance at some point in the coming years. Whether you go passive or active, Morningstar’s manager research team has identified many superb small-cap funds. For folks who pick their own stocks, I recommend screening the Morningstar equity analysts’ coverage for undervalued small caps.

[1] Banz, Rolf. 1981. “The Relationship Between Return and Market Value of Common Stocks.” Journal of Financial Economics. Vol. 9, No. 1, and Fama, Eugene and French, Kenneth. 1993. “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics, Vol. 33, No. 1.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.