The Morningstar LSTA US Leveraged Loan Index is up 2.09% quarter-to-date as of March 12 and is currently on track for a fifth consecutive month of gains.

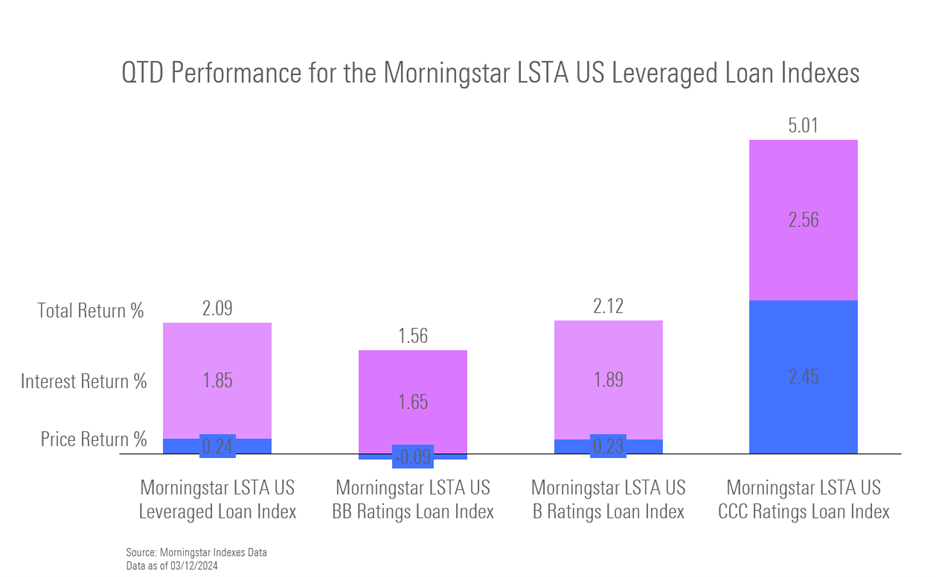

While the average bid price of the index has advanced to 96.69, up from 96.23 at the start of the quarter, gains can largely be attributed to the interest return portion as a result of ongoing elevated base rates. Quarter-to-date interest return for the index is at 1.85% relative to a price return of 0.24%.

Higher yielding, lower relative quality loans have driven index performance this quarter, with lower rated B and CCC facilities outperforming lower yielding, higher rated BB rated loans.

CCC rated loans, representing 7% of the index, currently yield 19.09% and have gained more than 5% for the quarter. B rated loans, representing 60% of the index, currently yield 9.77% and are up 2.12% quarter-to-date. Higher rated BB loans, on the other hand, make up almost 25% of the index but have gained just 1.56% over the same period .

Katie Binns, Director of Fixed Income & Multi-Asset, Morningstar Indexes:

“Attractive coupons are driving yet another quarter of strong performance for senior loans. Investor demand continues to outpace supply in the market, driving upward momentum in bid prices in the quarter and further boosting secondary market performance.”

Note: all data as of March 12, 2024

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.