These words were uttered by famed New York Yankee catcher and Baseball Hall of Famer, though not-so-famed investor, Yogi Berra.

Investors have indeed met a fork in the road in 2023 as the Morningstar US Core Bond Index has declined nearly 3% relative to about a 10% rise for the broad US equity market as of October month-end. While the negative correlation of returns between equities and investment grade bonds this year in many ways represents a return to traditional diversification principles, fixed income investors are likely to be disappointed with the result.

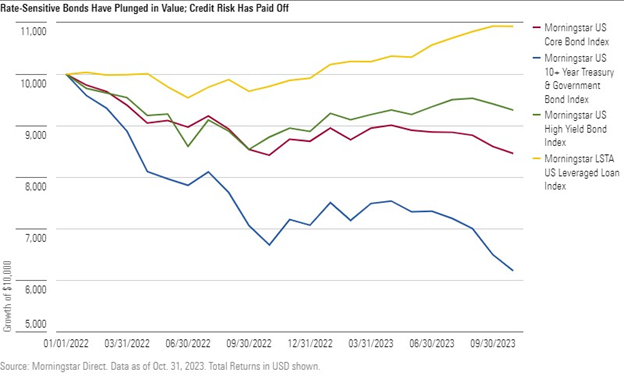

Yet a new study from Morningstar Indexes – Credit Risk Versus Rate Risk – Morningstar Indexes Reveal a Bifurcated Market for Fixed Income – identifies pockets of strength in the US fixed income market. While interest rate-sensitive indexes like the Morningstar US 10+ Year Treasury & Government Bond Index, which has declined more than 13% this year, have fared poorly, credit-sensitive indexes such as the Morningstar LSTA US Leveraged Loan Index and Morningstar US High-Yield Bond Index, which are up 11% and 5% respectively, have outperformed.

Katie Binns, Director of Fixed Income & Multi-Asset, Morningstar Indexes, said:

“For 2023, speculative grade instruments have had the upper hand relative to their investment grade counterparts. While more interest-rate sensitive bonds have been hit hard by persistently high interest rates and the steepening of the yield curve, credit-sensitive instruments have performed well as default rates remain low and the US economy remains resilient to the Fed’s efforts to tighten. In fact, US leveraged loans are the best performing asset class of 2023 and are on pace for its strongest year since the Global Financial Crisis.”