As Donald Trump begins his second term in office as the 47th US president, it’s not surprising that investors are already speculating about the implications for financial markets, and markets are already reacting.

But while policy matters, its investment impact is hard to predict and often overestimated—and politics are just one of the many forces that move markets, according to Morningstar Indexes Strategist Dan Lefkovitz.

Dan Lefkovitz – Strategist, Morningstar Indexes

“While elections can impact markets, they don’t take place in a vacuum. Markets have thrived (and sometimes crashed) for many reasons under presidential administrations of all stripes. Notably, equity returns under the past three presidential administrations have exceeded long-term historical averages. Predicting market performance under presidential administrations is tricky business.”

Key takeaways from Dan on politics, political parties, and investing:

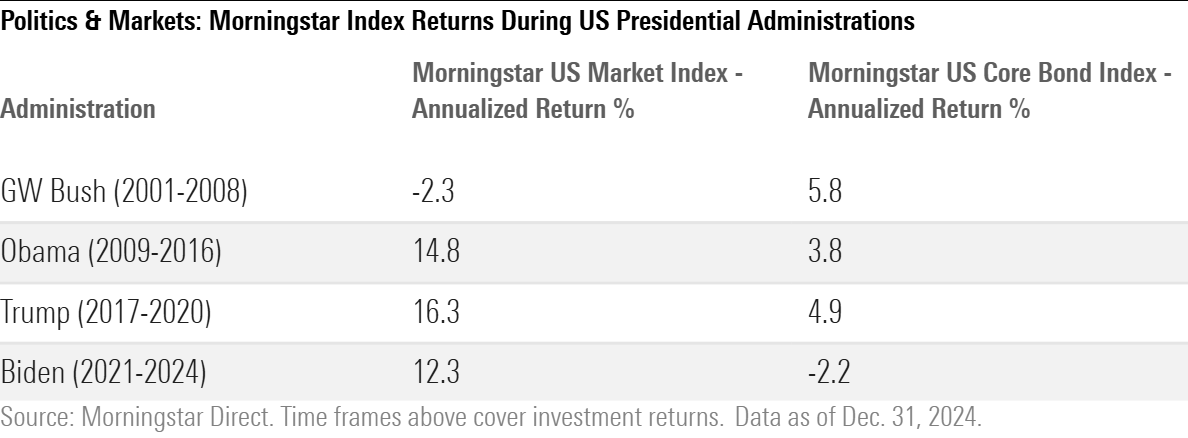

Context Is Critical. When comparing US equity and bond market performance under the past four presidential administrations, we see that stocks did best under Trump and performed worst under Bush. Equity returns under Obama were very strong, while stocks posted solid gains under Biden. It is important to look at politics within the broader market context. A range of factors impacted returns.

Post-Election Reactions Can Fade. Small-cap value stocks rallied after Trump’s election in 2016 and Biden’s election in 2020, only to see large-cap growth regain dominance over the US equity market. Sector leadership over the past two administrations is surprising. Energy, as in traditional oil and gas stocks, performed best under Biden. Technology was the best-performing equity sector under Trump, despite initial expectations that domestically oriented, “old economy” sectors would benefit most from his policies.

Presidents Are Familiar but Circumstances Have Changed. Yes, we may think we have seen this movie before, with Trump returning to office for a second term. But we shouldn't assume that market behavior over the coming four years will resemble 2017-2020. The context has changed. Plus, markets know that campaign rhetoric is one thing, but what actually happens under an administration is quite another.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.