With such a diverse range of company performance across US small- and mid-cap stocks in 2023, investors still looking for smid-cap exposure may want to apply a more selective lens to this asset class.

The Morningstar US Small-Mid Cap Moat Focus Index can help provide this lens. The index targets small- and mid-cap stocks with durable competitive advantages and attractive valuations, based on forward-looking insights from Morningstar’s equity research team. Introduced in July 2022 and tracked by the VanEck Morningstar SMID Moat ETF (SMOT), it has outperformed its benchmark, the Morningstar US Small-Mid Cap Index, in 2023 and since its inception date.

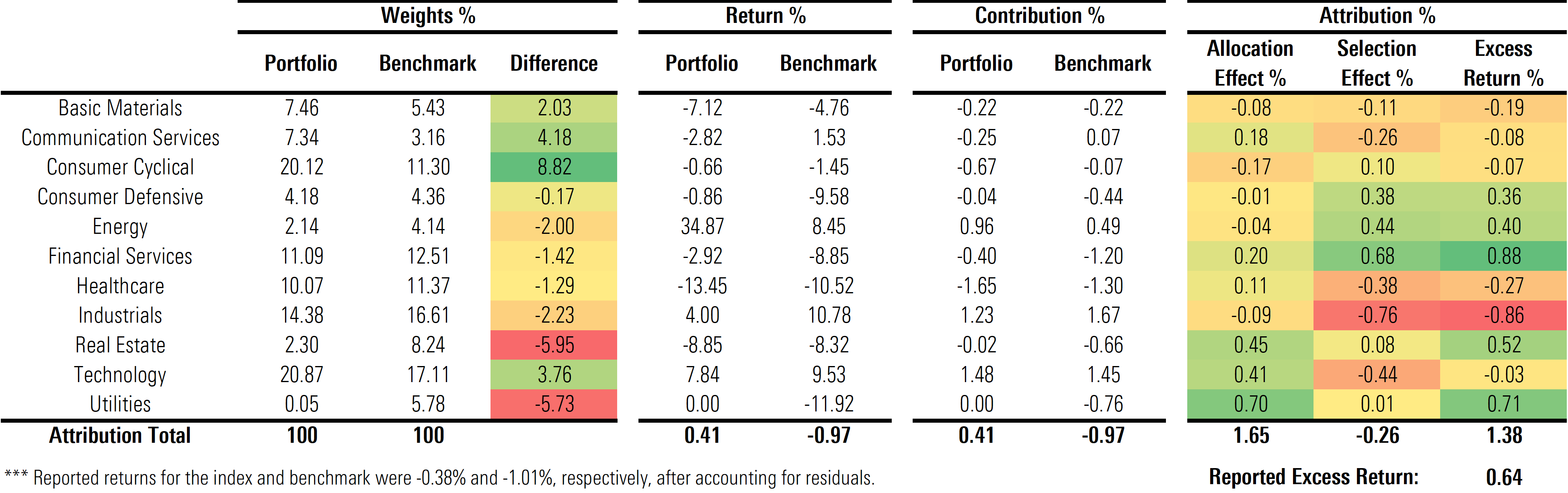

Underweight positions in the Real Estate and Utilities sectors and an overweight position in the Technology sector have proven beneficial year-to-date.

Data as of: 10/23/2023

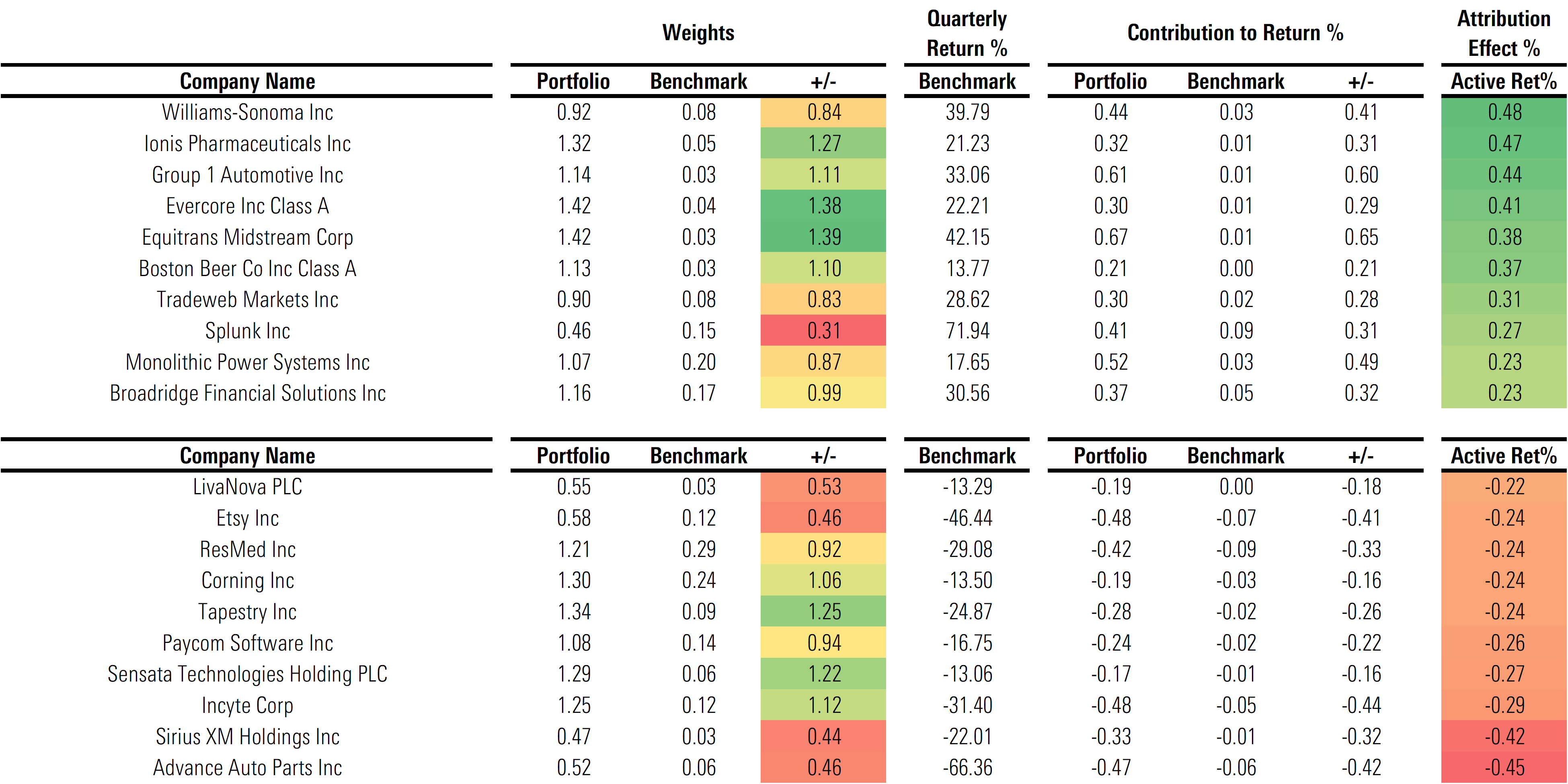

Top contributors to the index’s positive year-to-date returns include Williams-Sonoma, Ionis Pharmaceuticals, and Group 1 Automotive.

Data as of: 10/23/2023

Andrew Lane, Director of Equity Research, Index Strategies at Morningstar, said:

“While focusing on great businesses with durable competitive advantages is a good starting point, it’s critical to remain focused on valuation as well. As reflected by the favorable performance of the Morningstar US Small-Mid Cap Moat Focus Index, the combination of economic moat analysis and a disciplined approach to valuation from the Morningstar equity research team has delivered solid results in an otherwise underperforming asset class.”

Brandon Rakszawski, Director of Product Management, VanEck, said:

“Dispersions in performance and valuations can be more pronounced when going down the cap spectrum from large to small- and mid-cap stocks. For this reason, a more selective, research-driven lens can be even more beneficial for small- and mid-cap investors. Extending our moat index collaboration with Morningstar Indexes enables us to offer broader access to our clients.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar, Inc. is not affiliated with Van Eck. Van Eck's products are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in any Van Eck product.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.