The Takeaway

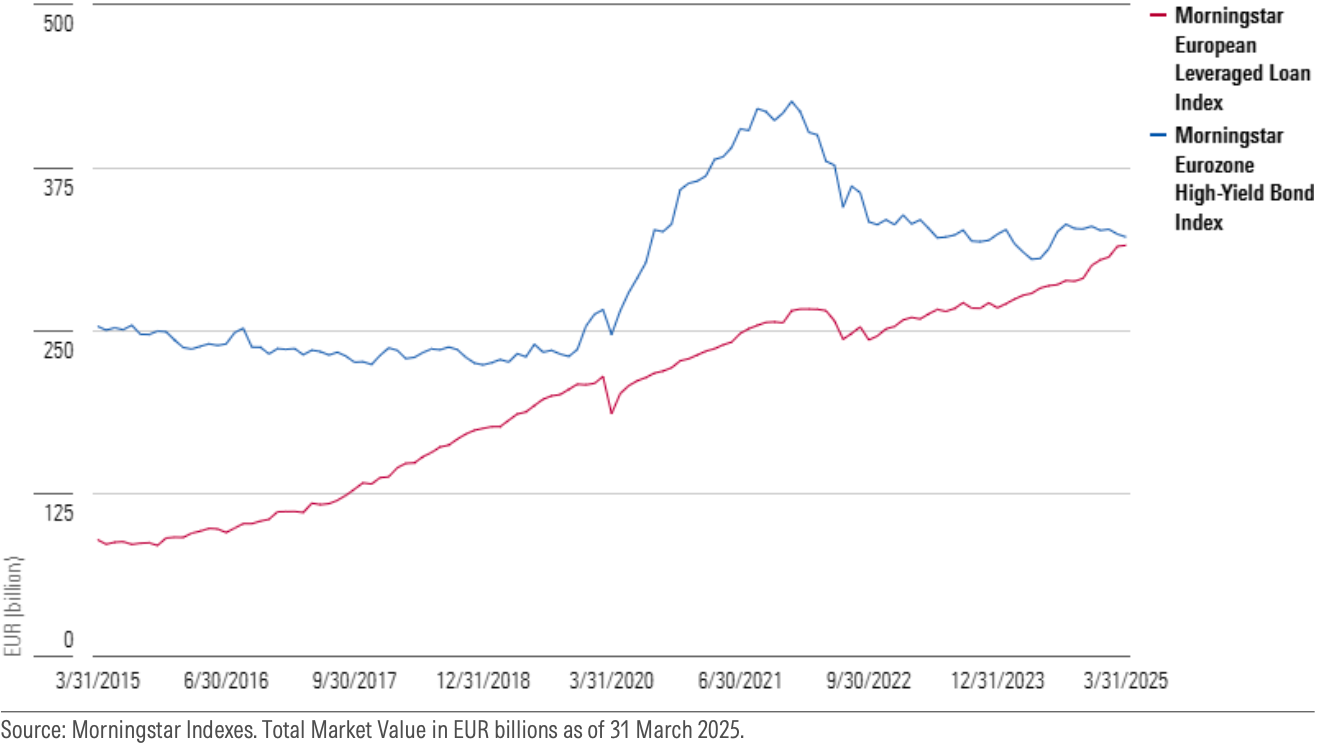

Measured by the Morningstar European Leveraged Loan Index, the market value for broadly syndicated loans, typically structured as senior secured corporate debt, has more than tripled over the past decade. In the US, the asset class is now larger than high-yield bonds, while in Europe, the two markets are of similar size. Financing demand from private equity-backed borrowers and buying demand from collateralized loan obligations are key growth catalysts. Some investors use the asset class as a parking lot for private credit allocations.

The Morningstar European Leveraged Loan Index's yield to maturity exceeds that of the Morningstar Eurozone High-Yield Bond Index by a substantial margin. The comparison is relevant because both asset classes carry serious credit risk.

From a volatility and diversification standpoint, leveraged loans compare favorably to high-yield bonds. Although the Morningstar European Leveraged Loan Index's credit-quality profile is lower than that of its high-yield bond counterpart, the index has experienced lower standard deviation of returns than high-yield bonds. Leveraged loans exhibit low correlations with both equities and government bonds.

Leveraged loans share many characteristics with sub-investment-grade corporate debt. Both are favorites of credit investors. In Europe, the two markets are of similar size, with the Morningstar European Leveraged Loan Index have tripled in market value over the past decade. In the US, leveraged loans are now larger in size than high-yield bonds.

There are key differences between the two asset classes, though, which have important implications. Leveraged loans are floating-rate in nature, whereas high-yield bonds typically have fixed-rate coupons, making them more price-sensitive to shifts in the yield curve. So, when central banks started hiking interest rates in 2022 and government-bond yields followed suit, the Morningstar Eurozone High-Yield Bond Index declined nearly 11% on a total-return basis. By contrast, the European Leveraged Loan Index lost 3.5% that year. Meanwhile, leveraged-loan yields surpassed 9% in 2023.

Bank loans are not without risk. Their economic sensitivity was on display during the global financial crisis beginning in 2007, then again during the "pandemic panic" of March 2020, and amidst the market turmoil of 2025. That said, loans are interesting from a diversification perspective. Though many investors like to allocate to the asset class tactically, there's reason to consider a strategic allocation.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.